|

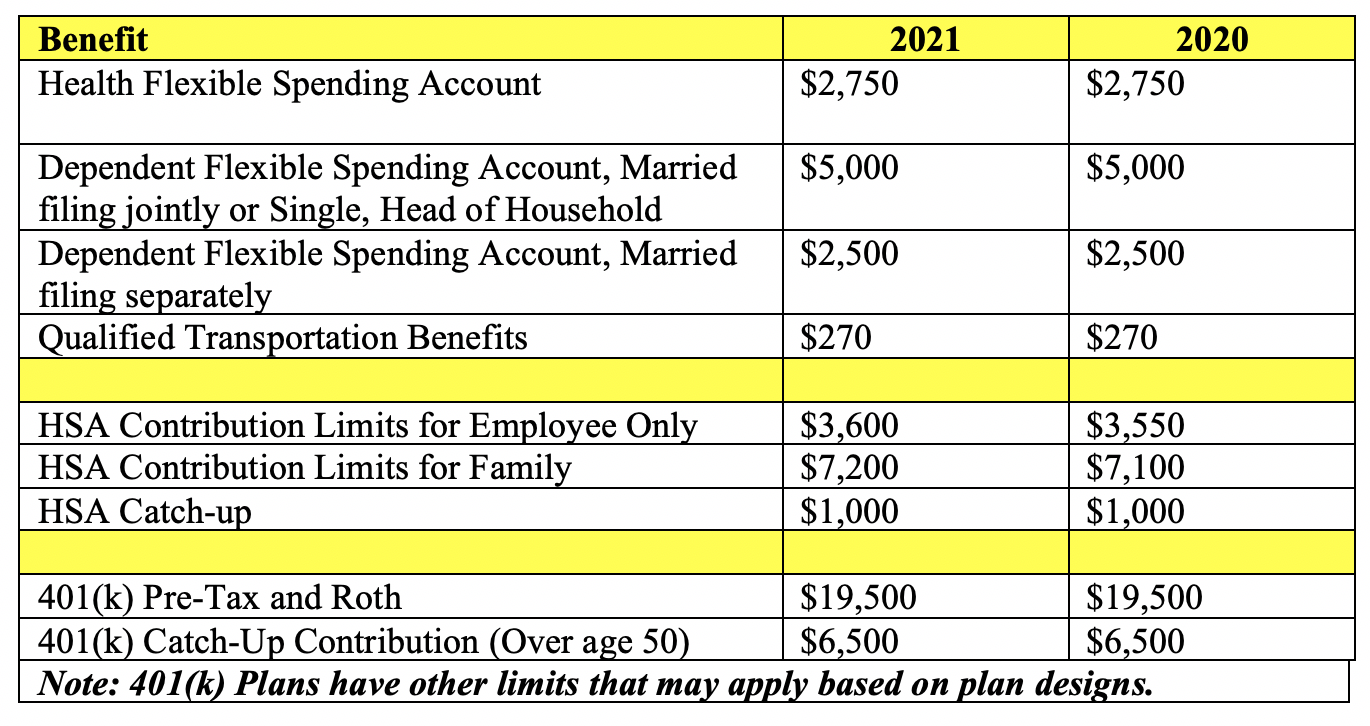

The benefit limits for Flexible Spending Accounts, Health Savings Accounts and 401(k) contributions have been announced for 2021.

0 Comments

When a notice from the Texas Workforce Commission(“TWC”) is received, employers need to act quickly. The deadline to respond is short and not responding by the deadline may have the TWC rule in the former employee's favor. When responding remember to: · Be consistent. If an employer has different statements between the initial response and a follow-up response, the hearing officer may become suspicious and the employer could be put in a difficult position. · Provide back-up documentation to support the response, whether it is a resignation letter or documentation of performance issues. Is a terminated employee eligible for unemployment? If the employee was discharged, the most common mistakes employers make that cause difficulty in unemployment claims, according to the TWC include:

Because of the many Unemployment questions, we will be providing more information in our upcoming newsletters.  The Department of Labor released proposed regulations to help employers determine if a worker is an “employee” under the Fair Labor Standards Act (“FLSA”) or an "independent contractor." If an independent contractor is determined to be an employee, the change of status will have an impact on the labor laws, payroll-tax requirements, income-tax laws, and laws governing employee benefits. The proposed regulation would determine a worker’s status based on if the worker is economically dependent on the employer for work or is in business for himself or herself. Two core factors being considered are:

Additional factors will be available if the core factors cannot make a determination. Additional factors may include (1) amount of specialized skill or training required (2) degree of permanence in the work relationship and (3) if the work is part of an integrated unit of production. The Department of Labor is currently taking comments on the proposed regulations. An expected date for the final regulations is not available at this time, but once finalized, employers should review all independent contractors to determine if they would be considered an employee.  All the legislation in the past few years has required employers to review their Employment Applications. Requested information, such as the items below, should no longer be included on an Employment Application.

|

Previous Months

February 2024

|

|

©2021 Human Resource Solutions LLC

|

|